straight to your inbox

Navigating the financial world can often seem like an intricate dance, especially when you are faced with similar-sounding options that have nuanced differences with potentially significant outcomes. One such comparison is the debate between a line of credit and a credit card, both powerful tools that can impact how you manage your money. Let’s unravel this intricate financial question to help you decide which instrument belongs in your wallet.

What Is a Line of Credit?

A line of credit is a financial arrangement between a financial institution and the customer that determines the maximum loan amount available. It operates much like a credit card but is unsecured like a personal loan. When you withdraw money, your available credit decreases. Conversely, when you make a payment, your available credit increases. It offers a degree of flexibility, allowing you to borrow the amount you need, when you need it, up to the established limit.

How It Works

Upon opening a line of credit, you establish a credit limit, the highest amount of money you can borrow. The lender will charge interest on what you borrow, and repayments can be set up as regular monthly payments or as a percentage of the amount borrowed, also known as the minimum monthly payment.

Advantages and Disadvantages

The flexibility to borrow and repay at your convenience is one of the significant advantages of a line of credit. It can also have lower interest rates compared to credit cards, particularly if it’s secured against an asset. However, the risk is that the flexible repayment terms might lead to higher interest costs if you’re not disciplined with repayments.

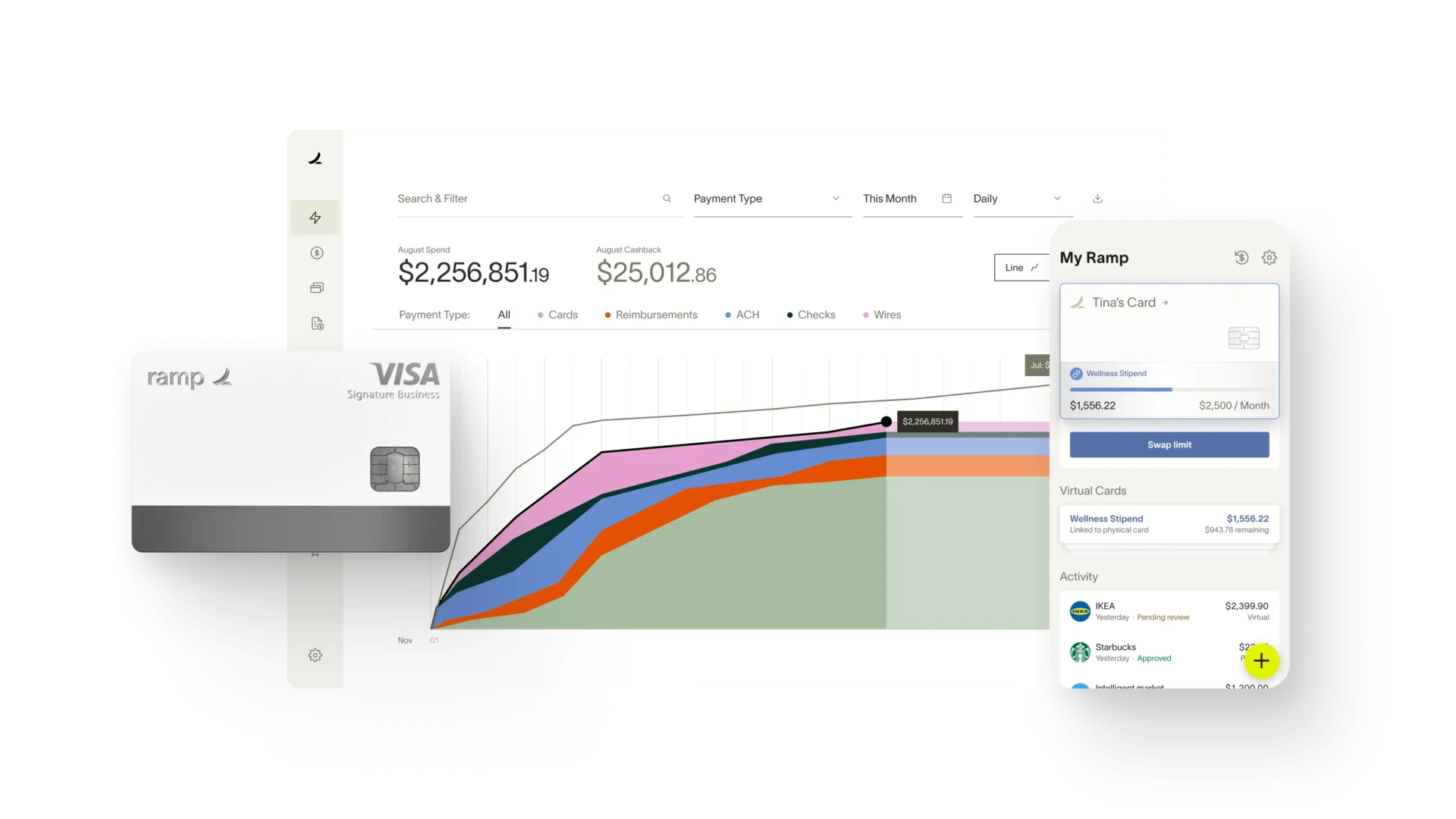

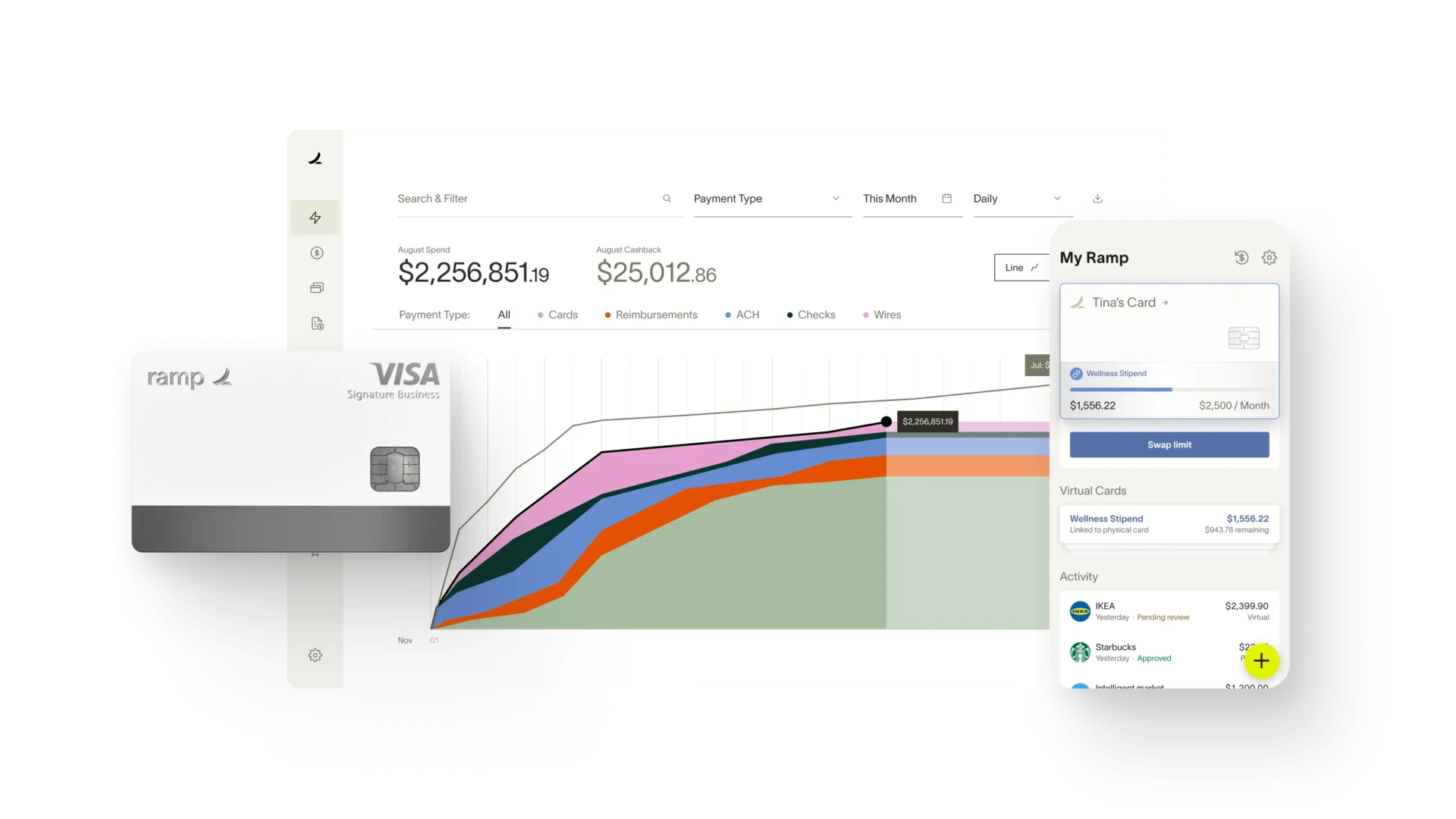

What Is a Credit Card?

A credit card is a plastic card issued by a financial company, allowing the cardholder to borrow funds to make purchases, or to pay merchants for goods and services based on the promise to the card issuer to pay them back, along with interest. It permits revolving credit—up to a certain limit on a line of credit—without the need to borrow more every time you spend.

How It Works

When you use a credit card, you borrow money up to a certain limit. You have a grace period, typically between 21 to 25 days, before you’re charged interest on your purchases. You are required to make a minimum payment each month, and you can choose to carry a balance from month to month, which accrues interest.

Advantages and Disadvantages

The convenience and widespread acceptance of credit cards are unmatched, and they often come with benefits like rewards programs and fraud protection. However, credit cards can also lead to high-interest costs, especially if you carry a balance or only make the minimum payment.

Key Differences Between Line of Credit and Credit Card

Understanding the difference is crucial in choosing the financial tool that best suits your needs.

Usage Flexibility

A line of credit provides more flexibility in usage as it isn’t tied to a specific need or purpose. This can make it a better option for managing irregular cash flow or dealing with unexpected expenses. In contrast, a credit card, while still offering some flexibility, is more typically used for daily expenses and can be more convenient for small, routine purchases.

Interest Rates and Fees

Generally, line of credit interest rates are lower than those for credit cards, especially if the line of credit is secured. However, credit cards offer a grace period that allows you to avoid paying interest on purchases if the balance is paid in full each month.

Repayment Terms

While both instruments offer flexibility in repayment, the practices associated with them can differ. Typically, credit cards require a minimum payment, which could be a small percentage of the balance, plus the interest accrued. A line of credit may have a minimum payment, but you will also be required to pay down the principal over time.

Impact on Credit Score

Both can have significant impacts on your credit. How much of your available credit you use is a significant factor in your credit score. A line of credit often increases the amount of credit available to you and might lower your credit utilization rate, which can help your credit score. Meanwhile, managing your credit card responsibly by keeping balances low and making regular, on-time payments can also boost your score.

When to Use a Line of Credit

A line of credit is best when you need periodic access to funds, such as for seasonal business changes or to fund ongoing home improvement projects where the cost is not fully determined upfront. Since it typically has lower interest rates, it can be a smarter borrowing choice for larger expenditures over a more extended period.

When to Use a Credit Card

Credit cards shine in day-to-day convenience and for small, predicted buys. Your average daily purchases can add up to a pile of rewards, miles, or cashback, if managed correctly. They are also great emergency tools, given the immediate access to funds, and many come with additional buyer protections and insurances.

Conclusion

The choice between a line of credit and a credit card depends on your financial situation, the nature of your expenses, and how disciplined you are with repayment. Both can be assets in your financial toolkit, but understanding their differences and how they align with your needs is vital in making the right financial decision. Remember, it’s not just about spending but about managing your borrowing wisely to avoid unnecessary debt and stress.