straight to your inbox

Effective expense management plays a crucial role in the financial health of a contractor, freelancer, or small business owner. However, this process can often be a time-consuming and error-prone task. Implementing automated expense reporting not only streamlines the process but also ensures accuracy and efficient organization of financial data. In this step-by-step guide, we’ll walk through the process of setting up an automated expense system – a transformative endeavor for those in the contracting and freelance spheres.

Introduction: The Need for Efficient Expense Reporting

Accurate and timely expense reporting is a vital aspect of any business operation, but for contractors, freelancers, and the self-employed, it can translate directly to profit. Traditional methods of expense tracking, such as manual entry and spreadsheet management, are increasingly being replaced by automated systems for their superior efficiency and accuracy. This comprehensive guide will equip you with the knowledge and tools to automate your reporting, allowing you to focus on the work you love, rather than the intricate details of tracking expenses.

Step 1: Choose an Expense Tracking Tool

The first step to automating your expense reporting is selecting the right tool. With an array of applications available, it's essential to choose one that fits the specific needs of contractors and is user-friendly.

Overview of Tracking Tools

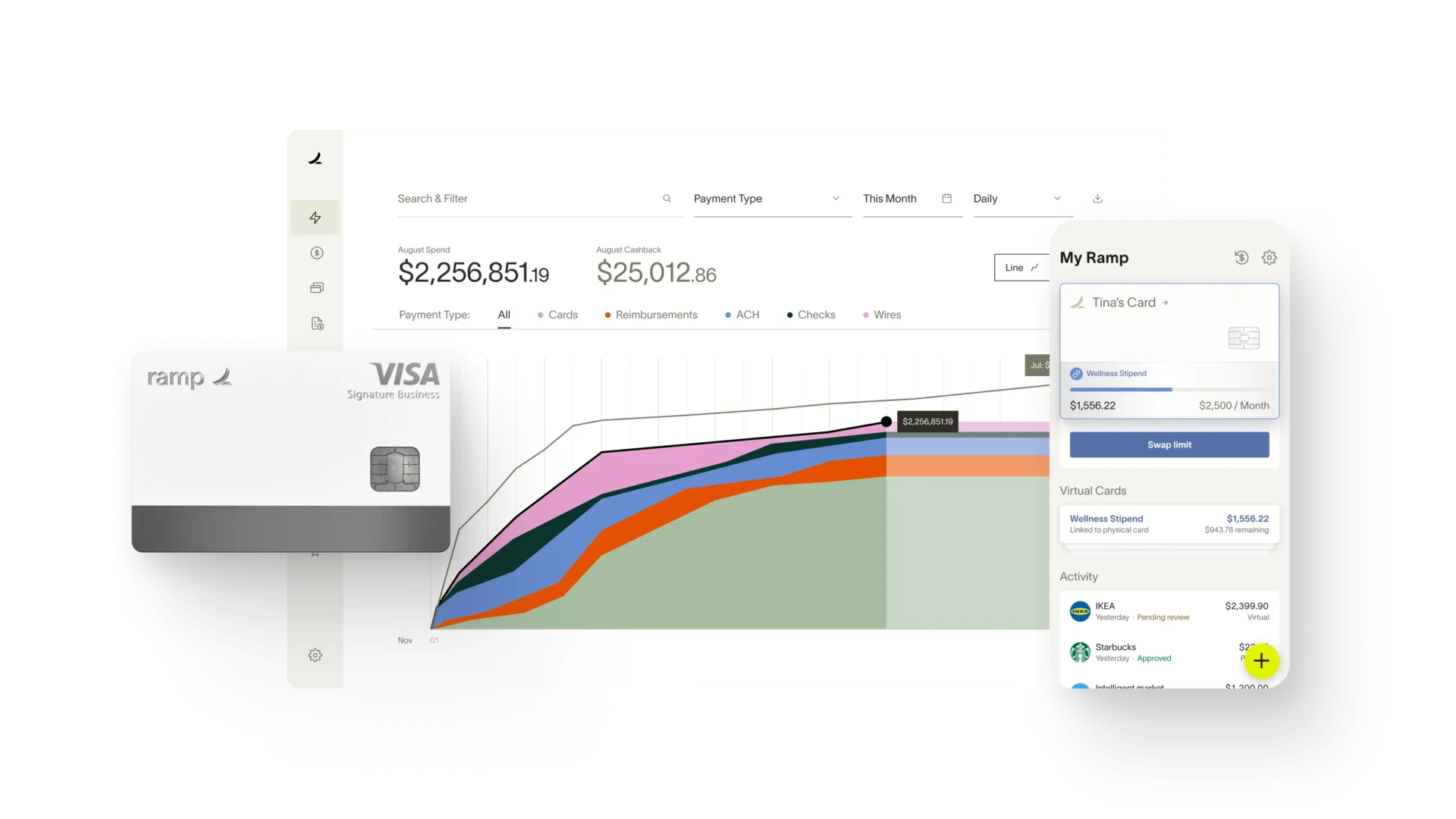

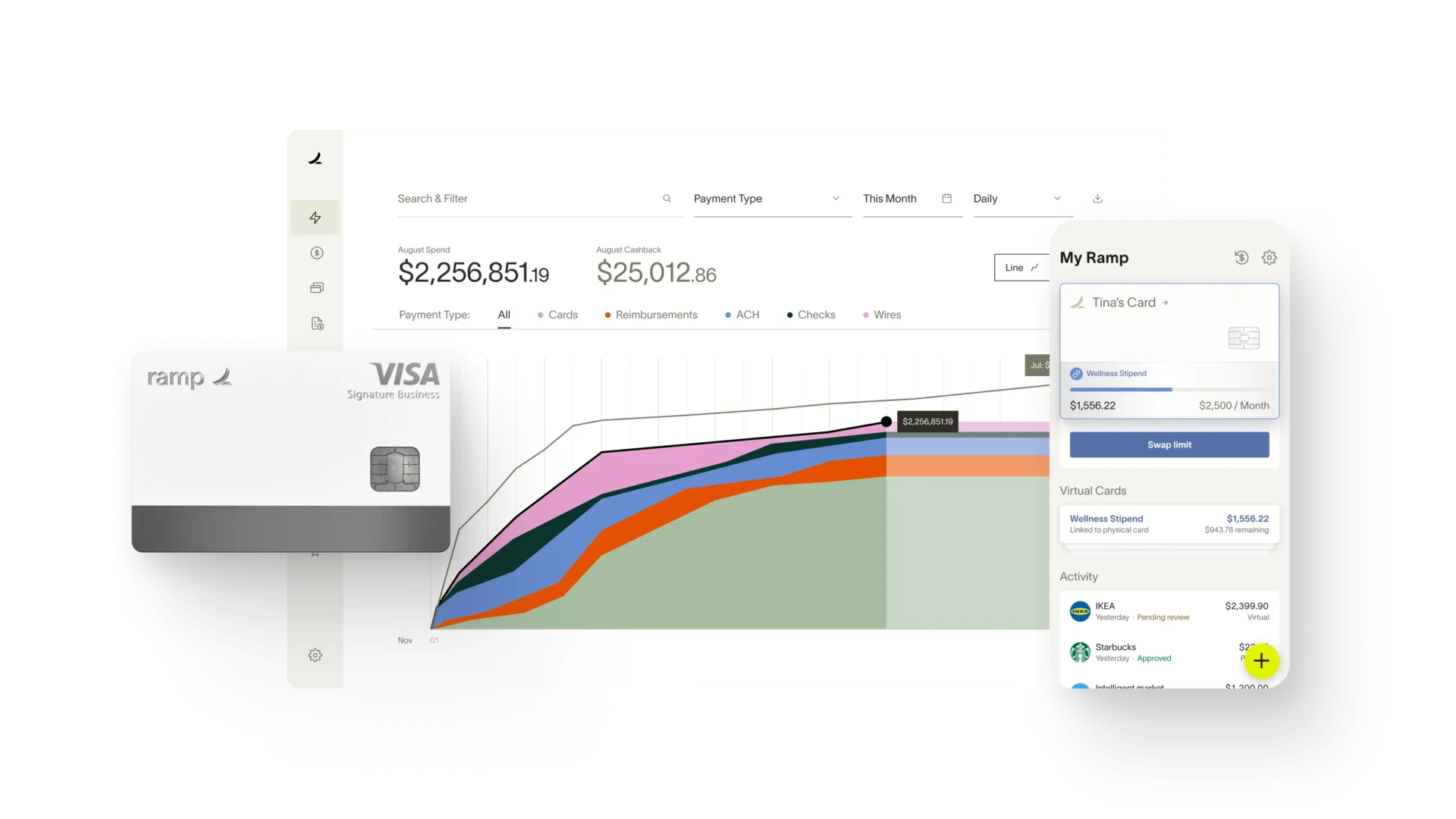

Popular expense tracking tools like Expensify, Concur, and QuickBooks Self-Employed offer diverse features, from receipt scanning to mileage tracking. They often come with mobile and desktop applications, ensuring accessibility and real-time tracking.

Contractor Considerations

Contractors should look for tools that support easy categorization of expenses related to their work. Features like tax categorization, multi-currency support, and the ability to export reports for invoicing or tax purposes are particularly valuable.

Step 2: Set Up Expense Categories

Organizing your expenses is the foundation of an efficient expense system. Start by identifying the most common categories for contractor expenses, such as travel, supplies, and professional development.

Common Expense Categories

Common expenses for contractors may vary but often include:

- Travel: airfare, lodging, rental car

- Meals: client meetings, business travel

- Equipment: software, hardware

- Office: supplies, internet

Customized Categories

Contractors with specialized needs can and should create custom categories to reflect their unique expenses, such as specific project materials or tools.

Step 3: Capture Receipts

In an automated system, receipt capture should be effortless and immediate. This is not only for legal and auditing purposes but also for accurate tracking and faster reimbursement.

Digital Receipt Capture

Leverage the camera on your smartphone to snap photos of receipts, or use e-receipt systems when available, such as email or website downloads.

Organizing Receipts

Use a cloud storage service to keep all receipts in one place, organized by date and category. This ensures you can always find a receipt when needed, without sifting through a pile of paper.

Step 4: Enter Expenses

Once you have your receipts, it's time to enter expenses into your chosen tracking tool. Precision and consistency in this step are key to an effective automated system.

Data Entry Best Practices

When manually entering expenses, record all necessary details, including the date, amount, vendor, and category. Be vigilant about selecting the correct category to avoid misreporting.

Consistent Entry

Develop a routine for entering expenses, such as at the end of each workday or as soon as a receipt is acquired. This habit ensures that no expense falls through the cracks and that your reports are always up-to-date.

Step 5: Automate Expense Reporting

The real power of an expense tracking tool is in its ability to automate the process. Modern tools can save you considerable time by learning from your entry patterns and applying rules to common expenses.

Configuration and Rules

Set up automation rules within the tool to categorize recurring expenses. For example, if your internet bill is always categorized as an 'Office Expense,' the system can learn to do this automatically.

Banking and Credit Card Integration

Consider connecting your tracking tool with your business bank accounts and credit cards. This integration can pull transaction data directly into the system, reducing manual data entry further.

Step 6: Review and Submit Reports

Automating your expenses doesn't mean you’re completely hands-off. Regular review is still necessary to ensure that all expenses are accurate and appropriately categorized.

Reviewing for Accuracy

Designate time, perhaps weekly or biweekly, for a thorough review of your expenses. Look for any anomalies or transactions that might have been miscategorized by the automation.

Submission Process

Once you're satisfied with your report, submitting it to clients, project managers, or the finance department is typically a simple process within the tool. This often involves generating a PDF report with the details of your expenses for the designated timeframe.

Conclusion

Automated expense reporting systems are not just a convenience; they are a professional necessity for any contractor aiming to run an efficient and profitable business. By following the steps outlined in this guide, you're taking a significant step towards financial organization and time-saving practices that allow you to focus on the core of your business. Embrace automation and watch as your reporting workload diminishes, and your financial accuracy improves.